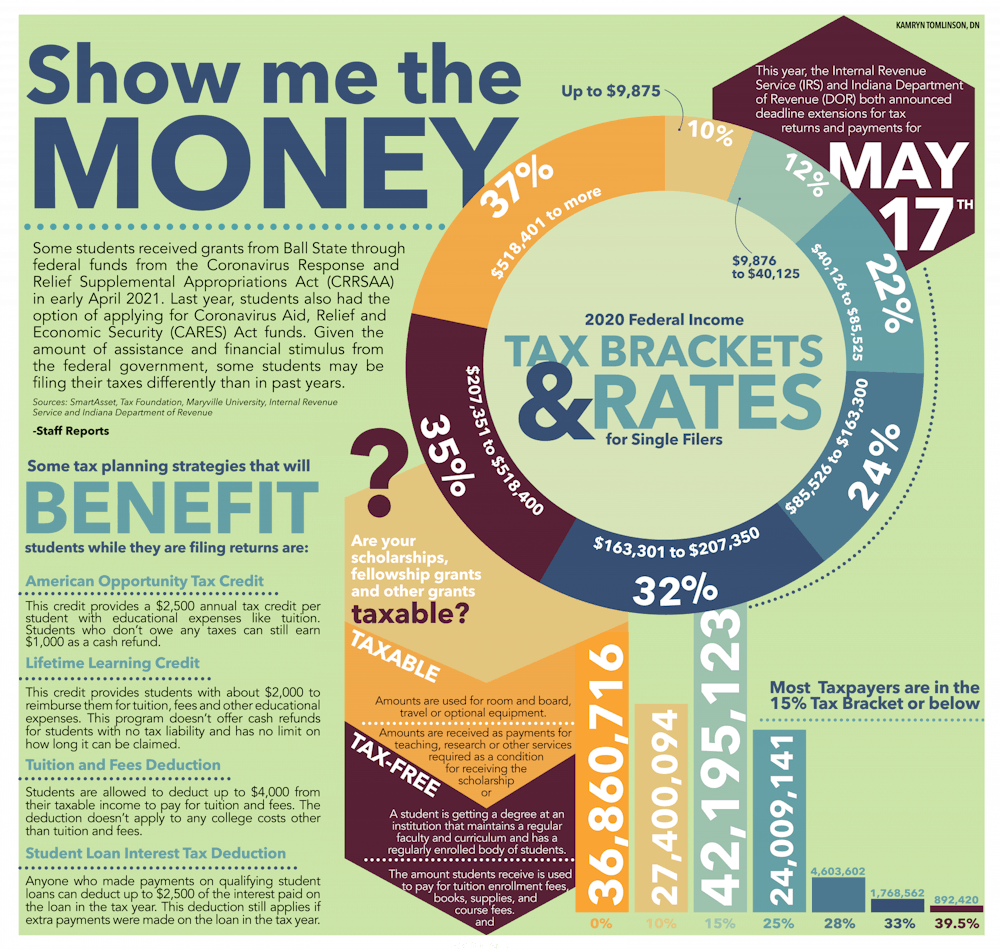

During the COVID-19 pandemic, many Hoosiers received federal unemployment assistance, which, according to the Indiana Department of Revenue (DOR), must be claimed as taxable income on state and federal income tax returns.

Students can only claim the American Opportunity Tax Credit, Lifetime Learning Credit, Tuition and Fees Deduction and Student Loan Interest Tax Deduction if they are filing as independents and are responsible for their own educational expenses.

Coronavirus Response and Relief Supplemental Appropriations Act (CRRSAA) and Coronavirus Aid, Relief and Economic Security (CARES) Act funds are not taxable to students if they were given under qualified disaster relief payments, including supplementing unmet financial need or unexpected expenses for housing, food or health care.

People who need to file an extension can do so with the DOR. The extension moves the filing deadline but not the payment deadline.